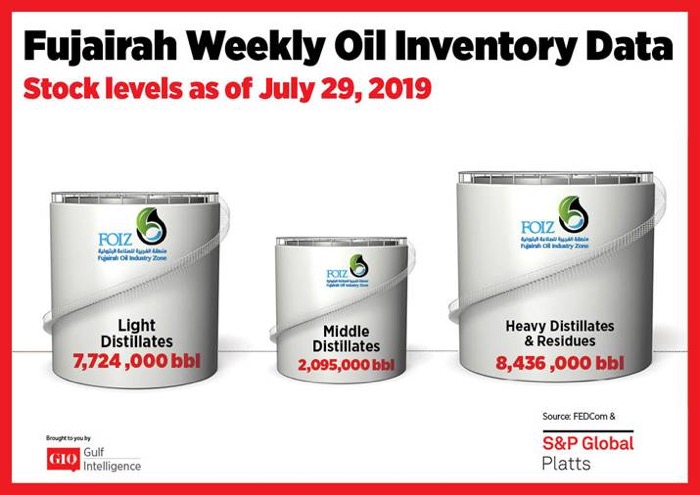

As of Monday, July 29 total oil product stocks in Fujairah stood at 18.255 million barrels, drawing down 1.124 million barrels week on week. Overall product stocks fell by 5.8% with a large drawdown in heavy distillate stocks, while light stocks showed a small build with middle distillate stocks largely unchanged.

Stocks of light distillates rose by 241,000 barrels reflecting a build of 3.2% week on week. Total volumes stood at 7.724 million barrels. The gasoline market East of Suez was seen as steady with a largely balanced picture, trade sources noted. “Physical [gasoline] market is still quite balanced, sentiment has gotten weaker, especially after the news of China’s third round export quotas,” a source noted. The FOB Singapore 92 RON gasoline crack against front month ICE Brent crude futures stood at $5.48/b Tuesday, reflecting a fall of 4 cents/b week on week, S&P Global Platts data showed.

Stocks of middle distillates fell by 0.3%, subtracting 6,000 barrels to stand at 2.095 million barrels at the start of the week. Middle distillate sentiment East of Suez remained relatively bullish with the continuous supply tightness in North Asia supporting the market, sources noted. “It’s the refinery turnaround season, plus there are still some ongoing outages,” a source said. The strength was reflected in the EFS which reflects the spread between 10ppm Singapore gasoil swaps and ICE low sulfur gasoil futures, which flipped into positive territory for the first time in 10 months at the start of the week.

Stocks of heavy distillates fell by 13.9%, dropping by 1.359 million barrels on the week to stand at 8.436 million barrels. Activity in Fujairah has picked up with availability of bunker barges at the port tightening as a result, sources said. “Cargo is not tight, just barges [are] busy with jobs,” a source noted. The spread between 380 CST delivered bunker in Singapore and Fujairah was assessed at $27.75/mt yesterday with the South East Asian port continuing to see higher prices. Tuesday’s spread reflected a rebound from the $15.75/mt spread between the two ports seen a week ago.

For more information, visit: https://goo.gl/yFt8kt