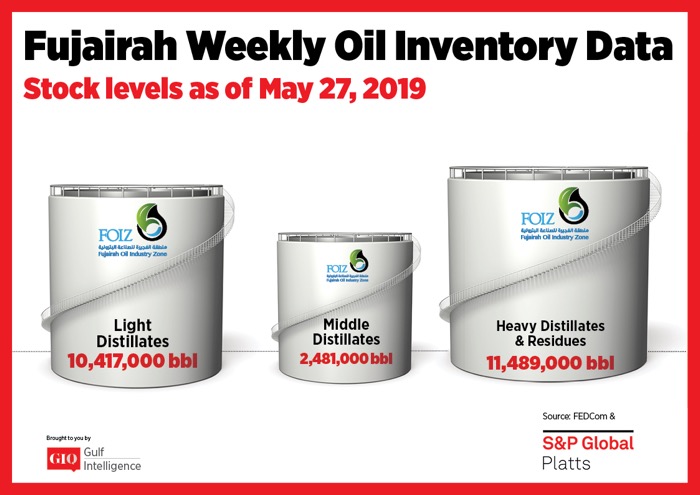

As of Monday, May 27 total oil product stocks in Fujairah stood at 24.387 million barrels adding 464,000 barrels week on week. Overall product stocks rose by 1.9% barrels with builds in both light and middle distillate stocks, while stocks of residue saw a slight fall.

Stocks of light distillates rose by 363,000 barrels reflecting a rise of 3.6% week on week. Total volumes stood at 10.417 million barrels, rebounding to levels seen two weeks ago. Overall heavy supply of material was seen as weighing on sentiment in the gasoline market East of Suez. The 92 RON physical gasoline crack to front month ICE Brent futures stood at $2.53/b on Tuesday, reflecting a fall of $2.51/b week on week and the lowest level since March 4 this year when they stood at $2.41/b.

Stocks of middle distillates rose by 6.8% adding 159,000 barrels to stand at 2.481 million barrels at the start of the week. The gasoil market East of Suez was likely to see surplus material flow into Singapore as European demand was seen to be stabilizing. In addition the East of Suez market is expected to be impacted by lower demand from India is likely due to the upcoming monsoon season. “Gasoil demand is going to be slow until Q3,” a trader noted.

Stocks of heavy distillates fell 0.5%, falling by 58,000 barrels on the week to stand at 11.489 million barrels. Within Fujairah barging schedules were tight for prompt dates for delivered bunker supplies but overall product availability was ample, sources said. Fujairah delivered 380 CST bunkers were assessed at $406.75/mt on Tuesday, reflecting a $3.75/mt premium to Singapore delivered 380 CST bunkers.

For more information, visit: https://goo.gl/yFt8kt